⇝ EAR 2024 ⇜

Eurorack Annual Report

A Comprehensive Analysis of Trends, Popularity, and Market Dynamics of Our 3U World

2024 Edition

The Eurorack synthesizer ecosystem continues to evolve, driven by both established manufacturers and emerging innovators. This report presents an updated analysis of current trends, sought-after modules, and shifting community preferences.

Drawing from MODULARGrid.net—the definitive resource for Eurorack enthusiasts—this edition builds upon last year's findings. Our dataset now encompasses over 15,000 modules, including all releases through the end of 2024.

The structure remains consistent with two primary sections: one examining modules and another focusing on manufacturers.

While each edition captures unique yearly developments, this 2024 report expands on the foundation established in the first edition, offering deeper insights. As the first update to the original report, we've implemented new indices specifically designed to analyze 2024 in detail. Rather than merely presenting the broader landscape, this edition highlights the year's most significant developments, providing a more nuanced view.

Methodology

Our analytical approach remains largely consistent with last year's edition, ensuring data continuity. All information comes from MODULARGrid.net, focusing exclusively on modules released through the end of 2024. To maintain accuracy, prototypes and unreleased designs are excluded.

Beyond the core dataset—covering module specifications, manufacturers, functions, popularity, dimensions, pricing, format, production year, and desirability—we've introduced three new indices to analyze manufacturer activity:

Constancy: Tracks consecutive years of activity where a manufacturer has released at least one new module.

Permanence: Measures the total number of manufacturers that have remained active without interruption.

Mortality Rate: Identifies manufacturers without new releases for at least two consecutive years.

This year's analysis benefits from refined data filtering that more effectively excludes panel variations. Although MODULARGrid now allows multiple panel options under single module entries, legacy data still contains duplicates uploaded by manufacturers. Our improved methodology ensures a more precise count of genuinely new designs.

These additions provide greater clarity on industry trends, illuminating the longevity and stability of companies within the ecosystem. As in previous editions, our findings are presented through visual data and detailed analysis.

1. New Modules Released

(Blanks and Panel Variations Excluded)

Following a consistent decline in new module releases after 2019, 2024 demonstrated a substantial rebound (+23%), approaching the peak levels of that record year. While 2023 represented a comparative low, this recovery suggests a renewed momentum, fueled by contributions from established names and market newcomers.

2. New Modules for Each Assembly Type

(Blanks and Panel Variations Excluded)

The 2024 growth was primarily driven by assembled modules, which experienced a strong resurgence aligned with the market's overall recovery. Conversely, DIY-only modules continued their downward trajectory, reinforcing the pattern observed in previous years.

The DIY & assembled category (modules available in both formats) maintained stability, but the broader shift indicates a preference for ready-to-use modules rather than purely DIY offerings.

This suggests increasing demand for convenience, with manufacturers prioritizing fully assembled products.

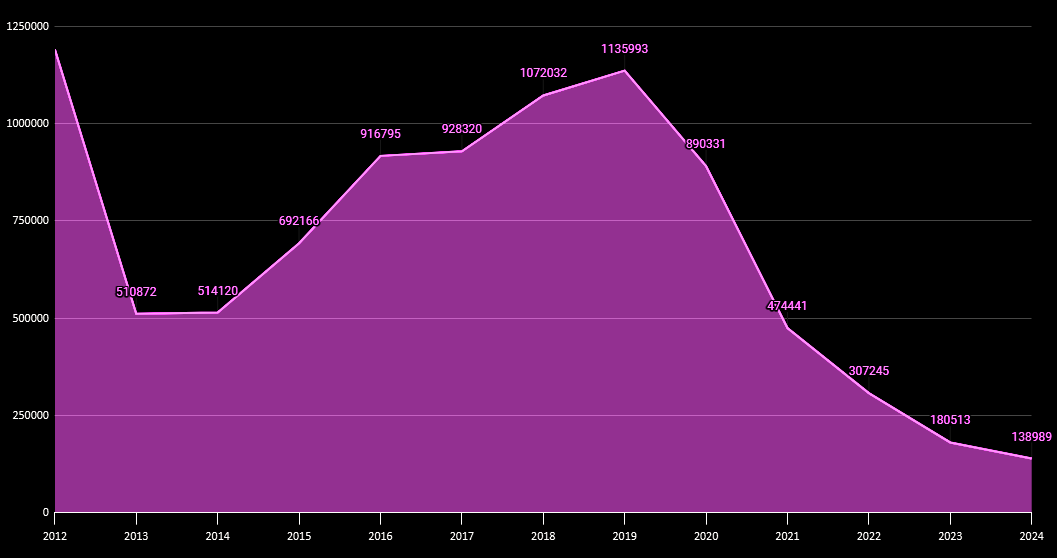

3. Total Number of Modules Added to Racks

The quantity of racks incorporating newly released modules continued to decline in 2024 (-23%), extending the downward trend observed since 2020. Despite the emergence of new modules and manufacturers, these innovations receive less immediate attention compared to previous years. This pattern suggests a market becoming more selective, where users increasingly focus on established favorites or specific innovations rather than embracing every new release.

4. Total Number of Modules Observed

Modules added to watchlists continued their decline in 2024, showing a 43% reduction compared to the previous year. This trend closely mirrors the decrease in rack additions, reinforcing the notion that newer modules generate less enthusiasm in the resale market. The 2019 peak remains unmatched, highlighting a shift in consumer behavior toward more discriminating acquisition strategies.

5. Average Price Through the Years

(Blanks and Panel Variations Excluded)

Module prices remained relatively stable in 2024, with only a slight decrease in the overall average—insufficient to indicate a significant shift. Despite fluctuations in component costs, pricing patterns suggest a balance between accessibility and production expenses. The previously observed decline in DIY module prices has slowed, while assembled module prices have shown minimal variation.

6. Number of Modules for Each HP Value

(Blanks Excluded)

General (2012-2024)

2024

The sixth visualization examines the distribution of module widths (measured in HP), excluding blank panels for accuracy. For the first time, we've isolated 2024 data in a dedicated graph, enabling comparison between current trends and historical patterns.

Odd HP Modules: As expected, modules with odd HP measurements remain virtually nonexistent, consistent with historical observations.

Small Modules (4-6-8 HP): A clear and persistent preference exists for compact modules in the 4-6-8 HP range. However, 2024 showed a slight but notable shift toward even smaller formats, deviating somewhat from historical averages.

Medium Modules (10-12 HP): In the medium category, 10-12 HP remain the preferred dimensions, with no significant changes from previous years.

Large Modules (18-20 HP): For larger designs, 18-20 HP continue as the favored sizes, showing no substantial variation in 2024.

Other Sizes: Modules of alternative dimensions remain considerably less common, aligning with historical data.

This distribution highlights the community's sustained preference for specific HP measurements, with compact modules being particularly sought after. While general trends remain consistent, the subtle shift toward even smaller formats in 2024 suggests a potential evolution in user preferences, possibly driven by space optimization or growing interest in ultra-compact systems.

7. Average Price for the Most Common HP Values

(30 or More Occurrencies, Blanks Excluded)

General (2012-2024)

2024

Completing our HP distribution analysis, the seventh visualization presents average prices for each module size (HP), excluding any HP measurements represented fewer than 30 times and blank panels. For 2024, we've enhanced the analysis by including average price per HP, providing additional insight into pricing dynamics relative to module dimensions.

Correlation Between Size and Price: A clear relationship persists between module size and price: larger modules typically command higher prices. This indicates that while size isn't the sole pricing factor, it maintains significant influence. However, the average price per HP gradually decreases as module size increases, suggesting that larger modules offer better value in terms of cost per unit of space.

Outliers: Notably, 22 HP, 38 HP, and 42 HP modules continue to deviate from the general trend, as they include numerous affordable options from major brands, which skews the average price downward. In 2024, 18 HP modules emerged as a significant exception, with an average price $20 higher than the general trend for their size. This anomaly may reflect the distinctive features or popularity of modules in this particular category.

Popular HP Sizes in 2024: The data highlights the most common HP measurements, with smaller modules (4-6-8 HP) maintaining their dominance. However, the 18 HP category stands out not only for its higher average price but also for its growing prominence in the market.

This analysis confirms that while larger modules generally command premium prices, certain sizes—particularly 18 HP—can vary significantly due to market dynamics, brand influence, or unique product characteristics. The addition of average price per HP further underscores the value proposition of larger modules, despite the notable exception of 18 HP.

8. Total Occurrencies of Each Function and Their Average Price

The eighth visualization illustrates the distribution of modules by function (bar graph) alongside their average prices (white line). For multi-function modules, the price was divided by the number of functions and allocated accordingly.

Utility modules continue to be most prevalent, followed by Oscillators and Stereo modules. Loopers represent the highest price point, while Blank Panels predictably occupy the lowest. Notably, shift registers remain underrepresented in the market.

9. Functions of The Top 50 Most Popular Modules in 2024

10. Functions of The Top 50 Most Observed Modules in 2024

The following two visualizations analyze the functions of 2024's most popular and most observed modules (top 50). "Observed" modules refer to those added to wishlists for potential future acquisition in the secondary market. This data carries particular significance, as users can only include a limited number of modules on these lists.

Popular modules demonstrate a preference for filters, while observed modules show a strong tendency toward stereo functionality. This divergence highlights distinct patterns between modules already incorporated into setups and those users are actively considering for future integration.

11. Release Year for Modules in the Top 50 Most Popular

12. Release Year for Modules in the Top 50 Most Observed

The eleventh and twelfth visualizations represent the release years of modules in the top 50 most popular and most observed categories. The data reaffirms 2018 as a pivotal year for the format, with a substantial concentration of both popular and sought-after modules originating from this period. More recent releases, however, appear to have made less impact on these rankings.

This pattern may be attributed to several factors. First, modules from 2018 may have achieved "classic" status, becoming essential components in many systems due to their proven reliability and versatility. Second, newer releases might still be gaining recognition and establishing their presence. Finally, the secondary market's emphasis on established, well-regarded modules could explain why recent introductions are underrepresented. This suggests that while innovation continues, newer designs require time to achieve comparable levels of adoption and desirability.

13. Most Popular Module Year After Year and Their Racks Count

Concluding the module analysis, we focus on the most popular module—added to the most racks—for each year.

The trend for the most popular module peaked in 2018, followed by a subsequent decline. The 2019 decrease may reflect heightened competition among leading modules, while the general downward trajectory in recent years suggests market normalization following the influx of new producers around 2017.

The most popular module of 2024 comes from Make Noise, marking the third time this brand has secured the top position. Compared to 2023, which saw a dramatic 77% reduction in popularity for the leading module, this year's decline was considerably more modest at just 9%, indicating a more stable environment.

For completeness, here is the list of the most popular modules year by year, along with their manufacturers and functions:

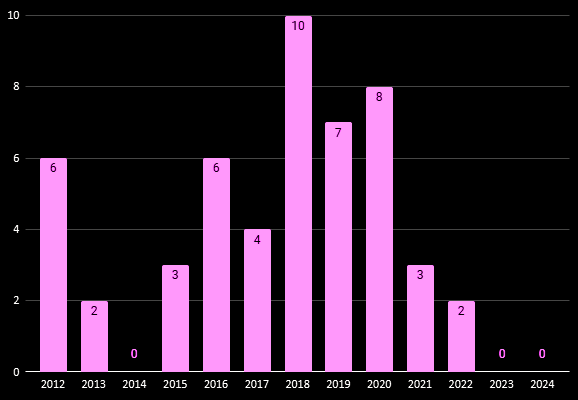

14. Manufacturers Through the Years

We begin our supply-side analysis by examining the number of active manufacturers—those releasing at least one module—year by year. We've introduced a dedicated section tracking first-time producers, defined as those introducing their initial module in a given year.

The number of active manufacturers has generally increased over time, reflecting growing interest and participation. From 2012 to 2023, there was a remarkable 274% increase in active producers, highlighting the market's expansion and vitality.

Following a 23% decline in new producers in 2023, 2024 witnessed a significant recovery, with a 74% increase in new entrants and a 14% rise in overall active manufacturers. This surge indicates renewed enthusiasm within the community.

With such a substantial increase in new participants, we anticipate exciting innovations and fresh perspectives at upcoming industry events.

15. New Producers Popularity

(Modules Added To Racks From Never Seen Before Producers)

16. Novelty Strenght

(Normalized New Producers Popularity)

Visualizations 15 and 16 expand on the theme of new producers by showing the number of modules added to racks from manufacturers making their first appearance that year. The Novelty Strength—calculated as the number of racks containing new modules divided by the number of new modules—serves as a key indicator of how impactful new designs are in the marketplace.

The data indicates that recent releases are gradually making less impact on the community. This trend may stem from several factors, with a primary consideration being the sheer number of active producers competing simultaneously. The market's saturation appears to be diluting the visibility of new offerings, making it increasingly challenging for users to track every release and potentially reducing overall engagement.

While the influx of new manufacturers enriches the ecosystem, it also presents challenges in maintaining audience attention and ensuring standout designs receive appropriate recognition. This dynamic underscores the importance of innovation and differentiation in an increasingly crowded marketplace.

17. Distribution of Producers by Number of Modules in Their Catalogue

(Blanks and Panel Variations Excluded)

18. Distribution of Producers by Number of Modules Released in 2024

(Blanks and Panel Variations Excluded)

These visualizations provide insight into the manufacturer landscape by categorizing producers based on their module catalog size.

For 2024, we've added a dedicated graph to compare current-year data with aggregate trends.

Key Findings:

Single-Module Producers: Historically, over 13% of producers have offered only one module, a pattern that persists in 2024, where more than a third of manufacturers released just one new design.

Emerging Producers (2-5 Modules): Approximately 30% of producers historically fall into this category, and in 2024, nearly half of all active manufacturers released 2-5 modules, establishing this as the dominant segment.

Established Producers (6+ Modules): Less than 20% of producers in 2024 released 6 or more modules, reflecting a marketplace still characterized by smaller-scale and emerging creators.

The ecosystem maintains its diversity, with a substantial portion of manufacturers being relatively new or operating at modest scales. While established and prolific producers continue their significant role, the 2024 data emphasizes the growing influence of emerging creators.

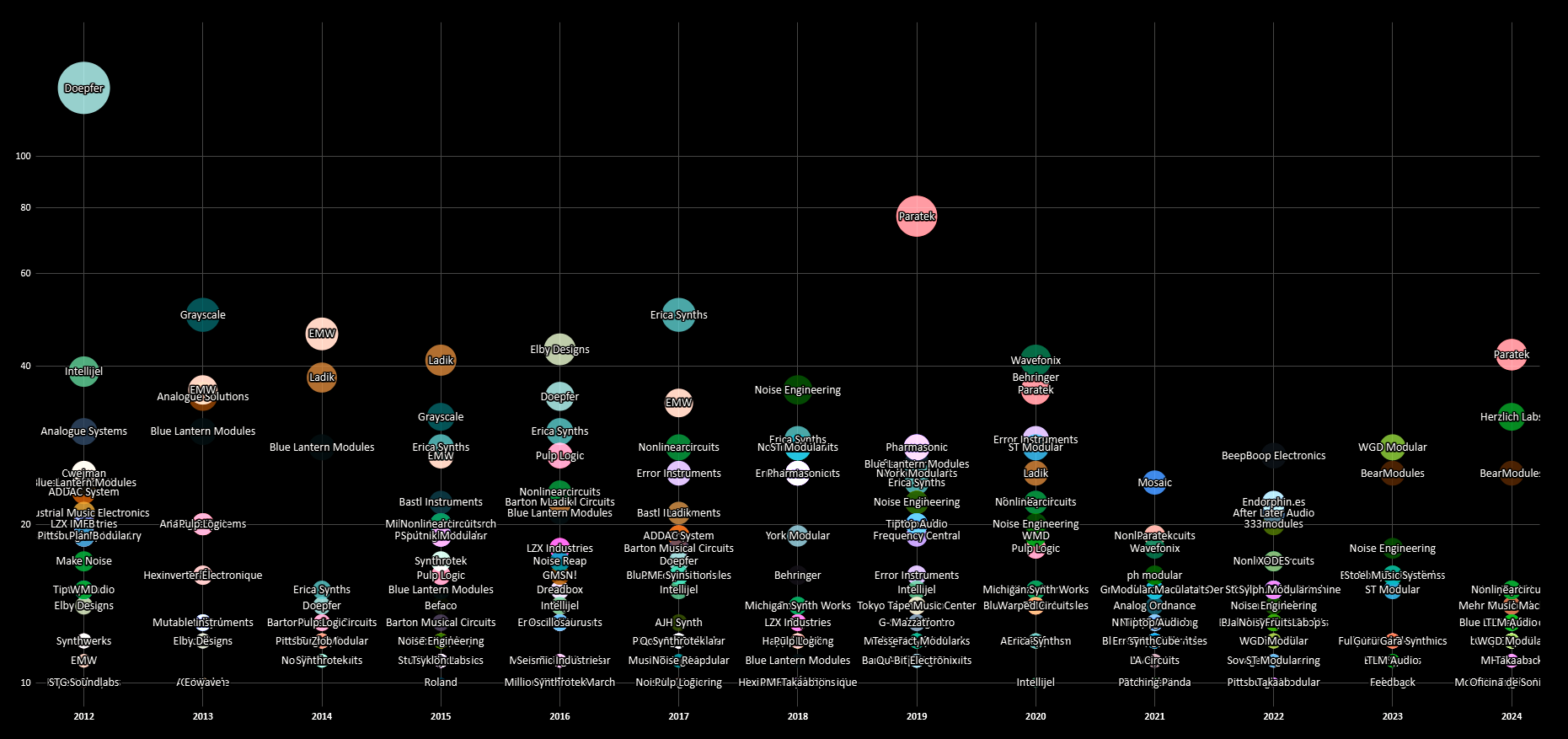

19. Number of New Modules from Each Producer Annually

(Blanks and Panel Variations Excluded)

We present an historical perspective on the Eurorack timetable, showing the yearly release count from producers who have introduced at least 10 modules in a given year. Using a logarithmic Y-axis, the graph highlights significant evolutions over time.

Historical Trends:

2012 Dominance: Doepfer's impact in 2012 remains remarkable, with an unprecedented number of pieces that established foundational standards for the Eurorack format.

Early Development (2012-2017): The market was initially shaped by a small group of key players releasing substantial module volumes, creating the framework for the format's expansion.

Post-2018 Diversification: From 2018 onward, the market transitioned toward a broader distribution of producers, each releasing fewer modules annually. This shift reflects increased market entry, specialty focus, and continuous innovation.

2024 Highlights: This year, Paratek again emerged as the leading producer, closely followed by two strong competitors. All other manufacturers with at least 10 releases fell within the 10-20 module range, confirming the ongoing trend toward diversification.

20. Number of Modules for Each Major Producer

(Blanks and Panel Variations Excluded)

As noted in the previous analysis, the Eurorack market remains fragmented, with certain manufacturers establishing leadership positions. This visualization highlights producers with more than 55 active modules (excluding blanks and panel variations).

Key Producers: A total of 45 manufacturers meet this criterion, representing less than 7% of all producers yet contributing 35% of all available Eurorack modules. This concentration underscores the substantial influence of these principal players.

21. Number of Modules Released From Each Producer in 2024

(Blanks and Panel Variations Excluded)

For 2024, we've introduced a dedicated visualization focusing exclusively on the year's releases. Notably, nearly 19% of new modules were published under "Other/Unknown," reflecting contributions from enthusiasts sharing prototypes or personal projects on ModularGrid. Paratek led the year with a significant 3%, followed by others at decreasing percentages.

The growing presence of independent creators enriches the ecosystem, highlighting the community-driven nature of this format.

22. Top 25 Producers by Popularity

(Modules Added to Racks)

General (2012-2024)

2024

This visualization focuses on the top 25 producers in terms of popularity, measured by the total number of modules integrated into racks from their catalogue.

Historically, the top 5 producers accounted for more than half of this segment, reflecting their substantial influence and appeal. However, 2024 has introduced new contenders into the top 5, indicating a shift in trends and user preferences.

The remaining 20 producers in this group have traditionally shared the remainder fairly evenly, but this year, several established top 25 producers are absent, further emphasizing the evolving dynamics of the marketplace.

These 25 producers still represent a significant portion of total interest, with more than 5.8 million modules added to racks out of a total of 8.8 million. However, the changes in 2024 highlight increasing diversification and the emergence of new favorites within the community.

23. Constancy - Years of Consecutive Production

This visualization introduces the Constancy Index, measuring the number of consecutive years manufacturers have maintained market activity.

The majority of producers remain active for only 2 consecutive years, with fewer sustaining activity for 3-4 years or more.

Interestingly, more producers have been active for 7 consecutive years compared to 6, likely reflecting the surge of new entrants beginning around 2018.

Only 13 producers have maintained consistent activity for 13 years—since the inception of our historical data. These enduring contributors include:

Doepfer

Pittsburgh Modular

Intellijel

Make Noise

AMSynths

Tiptop Audio

Blue Lantern Modules

Music Thing Modular

Expert Sleepers

ADDAC System

ALM Busy Circuits

Barton Musical Circuits

Nonlinearcircuits

While many producers demonstrate shorter market presence, this core group of established manufacturers has shaped the industry from its early stages. Their sustained influence highlights their adaptability and continued relevance.

24. Permanence - Percentage of Producers Remaining Active

The Permanence Index tracks the percentage of producers maintaining activity over consecutive years. This metric provides valuable insight into the sustainability and longevity of manufacturers in the Eurorack ecosystem.

Each colored segmented line represents the proportion of producers active in a given year who were also active in previous years. For example, the magenta line highlights 2024 data:

Of approximately 300 active producers in 2024, only 56% were also active in 2023.

This percentage decreases to 39% for producers active since 2022, and further diminishes to just 4% for those consistently active since 2012.

By using each previous year as a reference point and comparing active producer counts, we can observe how many maintain their presence over time.

This Index reveals the challenges of sustaining long-term activity in this specialized field. While many producers enter the market, only a small fraction remain active over extended periods. This underscores the competitive and dynamic nature of the ecosystem.

25. Trend of Disappeared Producers (Inactive in the Last Two Years) and Mortality Rate

(Percentage of Disappeared Relative to Total Active Producers)

This visualization introduces two complementary indices: the Trend of Disappeared Producers and the Mortality Rate. Together, they provide a comprehensive view of producer turnover in the Eurorack market.

Trend of Disappeared Producers (Bars): It represent the number of producers classified as "disappeared" in a given year. This designation applies to manufacturers inactive for both the current and previous year.

Mortality Rate (Line): It illustrates the Mortality Rate, calculated as the percentage of disappeared producers relative to the total number of active producers that year.

The data highlights the natural evolution of the Eurorack market, with a consistent number of producers exiting the ecosystem annually.

The Mortality Rate provides important context, showing how these departures relate to the overall pool of active manufacturers. This metric emphasizes the competitive and fluid nature of the market, where only a portion of producers maintain extended presence.

26. Most Popular Producer for Each Year

(New Modules Added to Racks)

Finally, we present the leading manufacturers year by year based on the highest count of newly released modules added to racks.

Historical Trends:

2012 Dominance: Doepfer's 2012 prominence remains legendary, with many of their designs experiencing renewed appreciation over time, maintaining their relevance.

Emergence of Key Players: From 2013 onward, Mutable Instruments, Make Noise, and Behringer emerged as industry leaders, each claiming the top position in multiple years.

This year marks Make Noise's return to the top spot after a five-year interval. While Behringer led in 2023 with a 64% decrease compared to the previous year's leader, Make Noise's 2024 performance shows only an 18% decline, indicating a positive market recovery.

Conclusions

This report benefits from an established historical framework, allowing us to focus specifically on 2024 while drawing meaningful comparisons with previous periods. Examining a single year in depth has provided clarity on current market dynamics, enabling the development of new analytical tools and insights:

Innovation and Diversification

The data confirms the Eurorack ecosystem's continued capacity for creative development. While overall patterns remain broadly consistent with 2023, there's a notable increase in new manufacturers entering the field. This expansion enriches the available module selection and introduces diverse design philosophies, potentially enhancing the technical sophistication of the market.Community Engagement

User participation remains central to market evolution. Platforms like MODULARGrid continue serving as vital hubs for knowledge exchange and feedback. The sustained level of community involvement indicates that collaborative development remains a cornerstone of innovation, with direct user input guiding both creation and adoption of new designs.Market Specialization

The influx of new manufacturers contributes to increased market segmentation. This specialization enables focused producers to address specific niche requirements, satisfying the distinct preferences of various user segments. The data suggests that while such specialization enhances product diversity, it also fosters a competitive environment where unique approaches are continuously refined.Economic Adaptability

Despite ongoing challenges related to component availability and broader economic factors, the market demonstrates resilience through alternative manufacturing strategies, including DIY approaches. The availability of modules across diverse price points maintains accessibility for enthusiasts and professionals alike, contributing to the sector's stability.Sustainability and Growth

A key challenge moving forward will be revitalizing interest among existing users while attracting newcomers. The continued growth in manufacturer numbers must be balanced with strategies to enhance engagement. Ongoing research into design optimization, coupled with responsive incorporation of community feedback, will likely prove essential to maintaining momentum in coming years.

In summary, the Eurorack market in 2024 presents a stable yet dynamic profile characterized by increased manufacturer diversity and targeted specialization.

Future development will depend on the ability of both established and emerging producers to leverage these strengths while addressing the challenges of sustaining engagement in an increasingly competitive and crowded environment.

See you next year!

Federico Intrisano